What are the different car leasing options?

May 29, 2024 by John Rawlings

If you want to finance your next car purchase, you are not alone. A very high proportion of cars are bought or leased through the many different types of car finance now available, such as personal contract hire (PCH), personal contract purchase (PCP) and the more traditional, hire purchase (HP). They make driving away in a brand new car more achievable for many people.

Most people prefer financing a car rather than buying it outright as it is a really easy, hassle-free and flexible way to keep updating your car.

We’d like to explain the different car leasing options for you so you know which suits you best.

Personal contract hire (PCH)

Personal contract hire (PCH) is a relatively new way for individuals rather than businesses to rent a car for a set period of time and annual mileage. You only need to pay a few months rental as an initial payment, and then an agreed monthly amount until the end of the contract, although there are other costs to consider during and at the end of the contract. It can be more affordable than other types of finance.

How does personal contract hire work?

With personal contract hire you make an initial payment, usually anything from three months to a year’s worth of the monthly amount (rather than a deposit), then pay the agreed monthly fee for a specific period of time – usually for a minimum of two years, or up to four years.

Contract hire is a form of leasing, and used to only be available to businesses. You should always check if any PCH monthly fees you look at have VAT included. A business can claim the VAT back, so leasing companies are used to displaying prices without VAT for them (to also make the cars look more affordable).

At the end of the agreement, all you have to do to change for another brand new one is to hand your one back, as agreed, and start a new contract for a new one. But please remember that you don’t own the car at the period you’ve been renting it for, and you won’t have any equity in it either.

The benefits of personal contract hire

The real benefit of personal contract hire is the convenience of renewing your agreement and getting a brand new car every few years without the same responsibilities of owning it and then having to sell it to buy your next one. You don’t have to rustle up a large deposit; instead you have the financial certainty and peace of mind of set regular motoring costs.

The drawbacks of personal contract hire

The only drawbacks of personal contract hire is that you won’t own the car at the end of the agreement. You will have to hand it back, so at that stage, you could say that you don’t have anything to show for the money you’ve spent on renting it. In reality, if you’d bought the car for cash, you’d have lost a similar amount of money in depreciation over the same period of using the car.

Personal contract purchase (PCP)

Buying a car with a personal contract purchase (PCP) is the most popular form of finance. Although its name sounds similar to personal contract hire, there is a big difference – one you hire the car and the other you have the option of owning it.

How does personal contract purchase work?

Personal contract purchase (PCP) works by paying a deposit (either cash or using any equity in your existing car), then you only have to finance a portion of the car’s value, leaving the balance of the car’s price to pay at the end of the contract (usually known as a balloon payment).

The benefits of personal contract purchase

The benefit of personal contract purchase is that you’re not financing all of the car on go, which makes the monthly payments lower. And at the end of your contract you can arrange to change for a new one or pay the balance and own it. It’s a great way to regularly be changing cars without going through the buying and selling routine.

The drawbacks of personal contract purchase

The only drawbacks of a personal contract purchase (PCP) are that you don’t own the car during the contract, you have to agree to an expected annual mileage, and if you want to take it abroad for an extended period (often more than 28 days) you may need permission from the finance provider.

You will have a good enough credit rating to be offered the finance in the first place, and then be comfortable having the value of the credit agreement on your personal credit records. It may affect your credit rating if you’re applying for any other finance, such as a mortgage. The credit reference agency may be concerned about the amount of financial commitments you already have.

If you do more miles in the car than agreed at the start, at the end of your agreement, if you hand it back, you will have to pay an excess mileage fee as the car is worth less the higher the number of miles it has covered. This isn’t a problem if you’re buying the car outright, unless that balloon payment is substantially more than the actual value of the car with that mileage.

Hire purchase (HP)

Hire purchase (known as HP) used to be the one and only way to finance a new car. It is different to personal contract purchase (PCP) as with HP you finance 100% of the car through monthly payments, and at the end of the agreement you have paid the full amount, so you own it (whereas with PCP, you finance a percentage of the car’s price and pay the balance at the end).

How does hire purchase work?

When buying a car (or any product) with hire purchase (HP), you pay an initial deposit and then finance the rest of the car’s price through monthly payments. At the end of the agreement you have paid off the full amount, so you own the car (unlike PCP where you have a ‘balloon payment’ (to pay at the end).

The benefits of hire purchase

A benefit of hire purchase (HP) is that you own the car at the end as you’ve financed the cost of the car, less your deposit. There’s no balloon payment at the end, unlike a PCP agreement. You aren’t restricted to a particular annual mileage, unlike other types of finance.

The drawbacks of hire purchase

Because you are financing a larger proportion of the cost of the car (less your initial deposit) so the monthly payments will probably be higher than other types of finance (eg. PCP). Also, interest rates on these loans can be higher.

If you don’t want to own the car at the end of the finance agreement, then HP will be a more expensive way to use your car for that period.

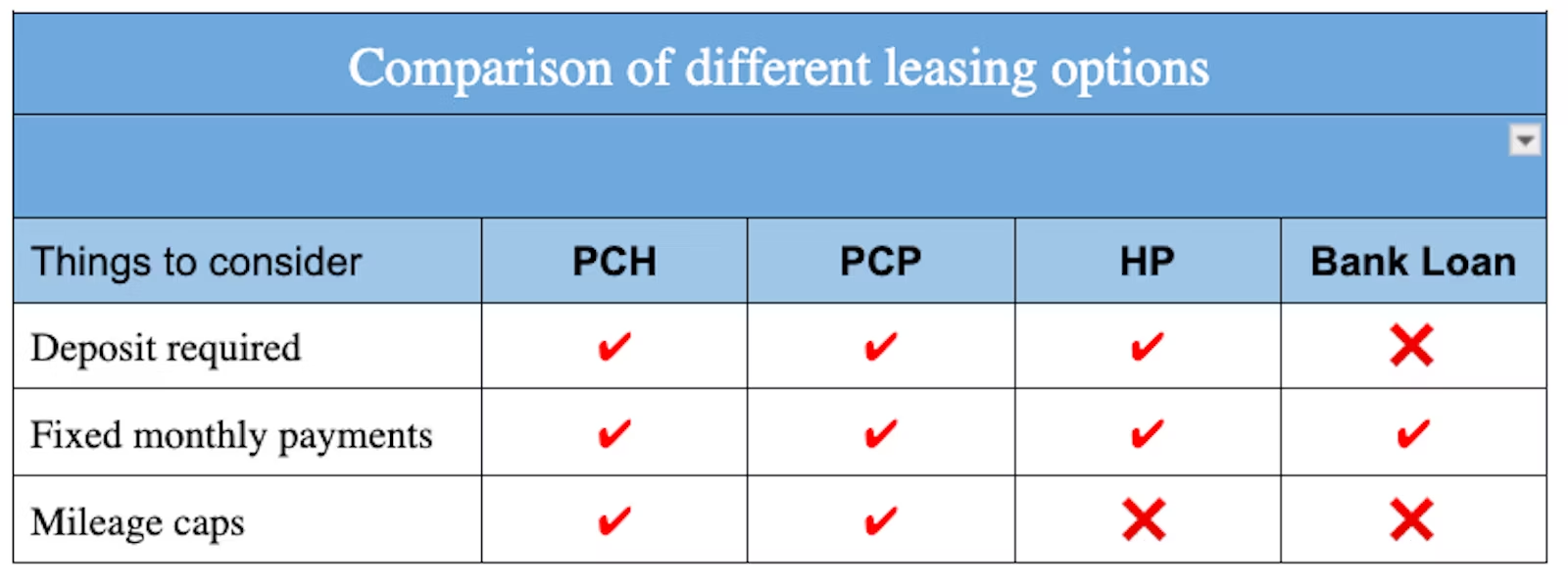

Comparison of different car leasing options

Car leasing options FAQs

What are different leasing options?

The different leasing options are Personal Contract Hire (PCH), Personal Contract Purchase (PCP) and Hire Purchase.

Is leasing a car financially worth it?

The benefit of leasing a car is that you only have to pay the initial rental (deposit) and then monthly amounts to have a brand new car on your drive. That’s particularly attractive if you don’t have the money to buy the car outright or would rather use it for other things.

Leasing a car gives you fixed monthly costs and a new car that’s covered by a warranty with all the latest features.

What is the best car lease term?

When you lease a car you usually have a choice of term for the agreement. This can vary from two to four years, typically. The best term is whatever suits you and how long you want to keep the car. A popular length of term has been three years, up to the point the car needs its first MOT.

Cars Change? Carwow!

Looking for a new set of wheels? With Carwow you can sell your car quickly and for a fair price – as well as find great offers on your next one. Whether you’re looking to buy a car brand new, are after something used or you want to explore car leasing options, Carwow is your one stop shop for new car deals.