What is a balloon payment on a car?

January 12, 2024 by John Tallodi

Wondering what a balloon payment is on a car? You’ve come to the right place

Once you’ve finished browsing Carwow for your next new car, you’ll need to decide how bets rto pay for it. Buying a car on finance allows you to manage your cash flow and lets you drive a new car without having to pay for it upfront.

It also means you’ll come across several acronyms and a few strange phrases. One of these is ‘balloon payments’, and we’ll discuss why it’s so important to consider when taking out car finance.

What is a balloon payment for car finance?

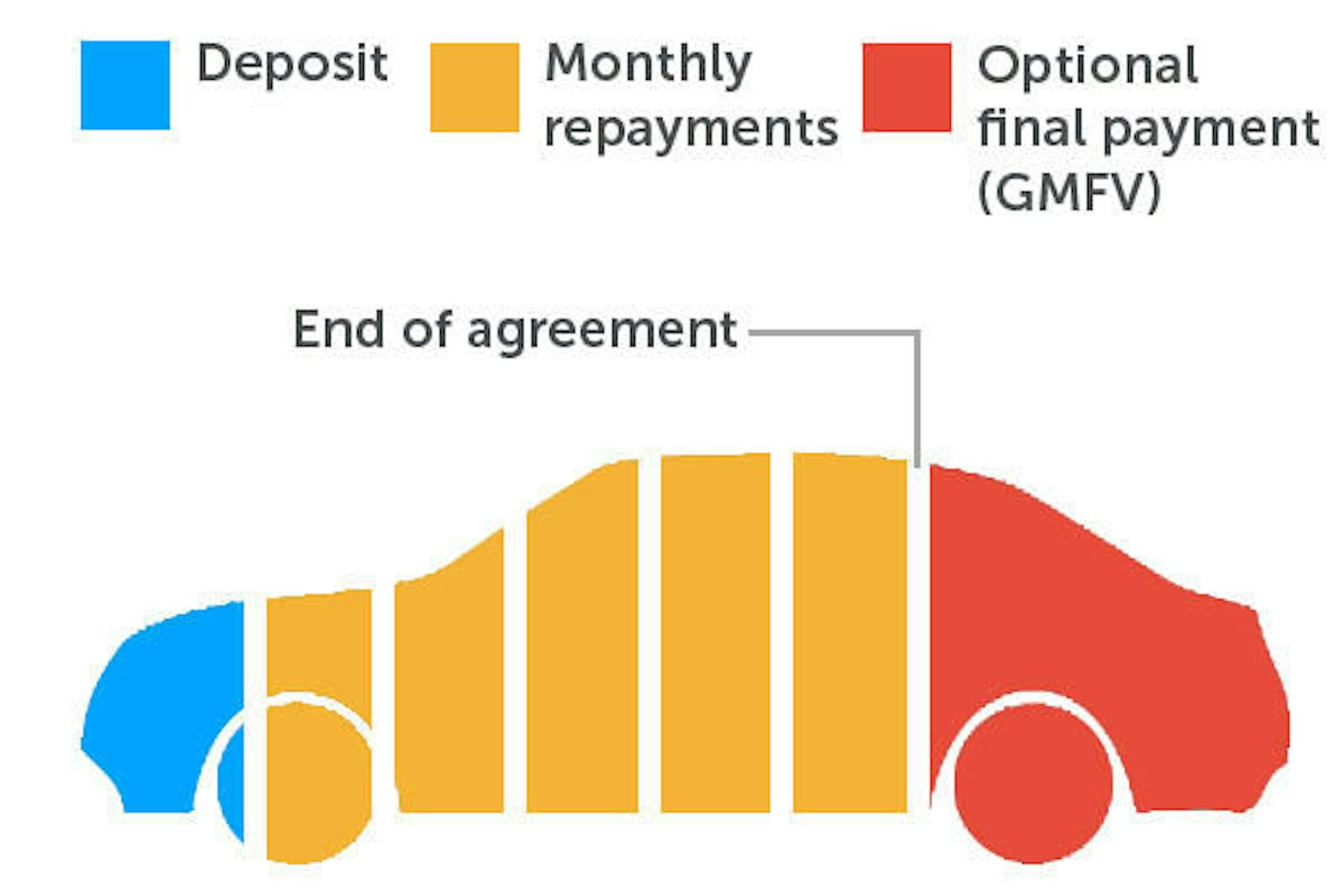

A balloon payment is usually offered with PCP (Personal Contract Purchase) car finance. PCP deals see your deposit and monthly repayments pay off a car’s depreciation over the course of the contract.

The balloon payment is actually the value that the car has retained over the course of the deal – IE all the car’s value that has not been paid off.

The balloon payment is technically known as the GMFV (Guaranteed Minimum Future Value), and it is set at the start of the contract, having been worked out based on a car’s predicted depreciation.

It is possible for a car to depreciate more or less than was predicted, but because the balloon payment will be written into the contract from the start, this will not change. If the car has depreciated less than predicted you can, assuming you stay with the same car/finance company, use any ‘equity’ built over the course of the deal to go towards the deposit on a new car.

We place ‘equity’ in inverted commas as while this is a commonly used phrase in the world of buying cars, this money is not actually equity; rather, it represents the fact that the car has depreciated less than expected, so the repayments you have made above this can be put towards a new deal.

How is a balloon payment calculated?

Balloon payments (also known as optional final payments) are calculated by working out the difference between the purchase price less the deposit and total monthly payments you make towards the vehicle and its estimated future value. Sounds a bit confusing but in essence what you are doing is only paying for the expected depreciation of your car (less the deposit) for the contract period. Cars that retain their value well tend to have lower monthly payments.

Let’s look at a simple example:

- You decide to finance a car with a £50,000 purchase price

- You are offered a 36-month contract at 0% interest* and £10,000 deposit

- The expected value of the car after 36 months is £25,000

- That means you’ll pay £416,17 p/m

Purchase Price

£ 50,000

Deposit

£-10,000

36 Monthly Payments

£-15,000

Balloon Payment

£-25,000

At the end of the 36 months, you can either hand back the keys or pay the £25,000 balloon payment and take ownership of the car.

*We have used a 0% interest rate for ease of calculation, but in most cases, you will be charged interest and it will be based on the loan amount as well as the balloon payment amount.

What happens when the balloon payment is due?

Once you have come to the end of your finance deal, the balloon payment becomes due. You have three options:

Settle the balloon payment

This will require a cash payment upon which you will be the owner of the vehicle. This is a good option if you do not intend to buy a new car or feel that the car is worth more than the balloon payment amount.

Hand back the car

If you do not want to finance a new car or feel that your current vehicle is worth less than the balloon payment owed, you can simply hand the keys back and end the finance agreement.

Take out a new finance deal on the car

If you want to keep the car but do not have the full amount to settle the balloon payment, you can refinance it and continue making monthly payments.

If you choose a PCP contract it will mean a new deposit, monthly payments and a recalculated balloon payment. If you go with a HP (Hire Purchase) agreement, your monthly payments will be higher but there will be no balloon payment at the end as you will own the car once the contract ends.

Is car finance with a balloon payment risky?

A loan of any nature can be risky if you have not worked out whether you can afford it beforehand. With a PCP deal you will need to stress-test your earnings to ensure that you can afford not only the monthly repayments but the balloon payment as well. To lower your monthly payments and the final balloon payment, you can pay a larger deposit upfront.

If you intend to hand the car back at the end of your finance agreement, you won’t need to budget for the balloon payment, but you may still need to have something set aside for a deposit on a new car. If you cannot afford the monthly payments the car may be repossessed, and you will be liable for any outstanding amounts.

What car finance options don’t use a balloon payment?

There are several ways to finance a car that don’t involve balloon payments:

Hire Purchase (HP) agreements comprise of a deposit and monthly payments that can span up to 60 months (five years). The monthly payments are higher than with a PCP deal because you are paying off the total value of the car. Once you have made the final payment the car is yours.

Personal contract hire is a long-term rental agreement for individuals. You pay an initial deposit which is usually between 6-12 months of the monthly payment amount. Then you pay a monthly instalment for an agreed period which can range from 12 to 48 months.

Once the agreement has come to an end you hand the car back. There is no option to purchase it outright and as long as you have met the contract requirements regarding mileage covered and vehicle condition, there is nothing further to pay.

Personal loan

This is a loan from a financial institution which can be used for purchasing high-ticket items such as a car. Payment terms are dependent on your specific agreement, and will usually involve a set number of monthly payments at a fixed interest rate. There is no balloon payment or deposit. The loan amount is paid to the dealer so as far as they are concerned it is akin to a cash payment.

Cars Change? Carwow!

Looking for a new set of wheels? With Carwow you can sell your car quickly and for a fair price – as well as find great offers on your next one. Whether you’re looking to buy a car brand new, are after something used or you want to explore car leasing options, Carwow is your one stop shop for new car deals.